Annual Pay Remit Technical Guidance

This guidance sets out the steps for completing an annual Pay Remit and covers the approval process relating to annual pay increases for staff.

Overview

Pay awards can be informed by a range of factors but will be subject to any limits and/or requirements set out in the Finance Director (FD) letter for the applicable year. While it is imperative that public sector workers have the necessary skills and expertise and are properly motivated, consideration must also be given to ensure proposed increases are / remain affordable within departmental budgets and enable essential public services to be sustainably funded going forward.

Who does this guidance apply to?

All public bodies whose expenditure scores against the NI DEL are required to complete an annual Pay Remit and submit this to the appropriate approval authority. This includes all NICS departments (including non-ministerial departments), agencies, Non-Departmental Public Bodies (NDPBs) and other relevant ALBs.

Staff groups currently not covered by the annual Pay Remit process include: staff employed by Public Corporations, Higher Education, District Councils, North/South Bodies and Ministerial appointments (however, contractual conditions of all new Ministerial appointments should still include adherence to the principles of public sector pay).

It should be noted that the annual Pay Remit process for civil servants in NICS departments is separately applied by NICS HR, which takes account of public sector pay parameters when determining the NICS pay award. ALBs that choose to follow NICS terms and conditions, but whose staff are public servants, not civil servants, must wait for the NICS determination before submitting an annual Pay Remit to their parent department for approval.

Completing an annual Pay Remit

Two related documents make up the annual Pay Remit:

An annual Pay Remit submission is not complete unless these two related documents are completed, these can be found on the Completing an annual Pay Remit page. Both these documents must be completed for each staff group and submitted together for approval, in line with the appropriate approval process as set out in this guidance. It is recommended that ALBs complete the annual Pay Remit calculations (Excel) first as this will underpin the pro forma (Word). The first tab in the Excel contains instructions for completion and a worked example is provided in another tab.

Proposals should be supported by appropriate HR, finance and legal advice which should be evidenced and provided where appropriate.

When staff working within the same ALB are subject to different pay agreements or pay determination processes, a separate annual Pay Remit must be submitted for each staff group.

Additionally, an ALB must not split its submission of annual Pay Remits with one annual Pay Remit for incremental progression and another for revalorisation. However, there may be a need in certain circumstances to do this. This guidance sets out the specific circumstances in which temporary cover may be acceptable.

Roles & Responsibilities

Please note that it is important that the relevant experts e.g. HR, Legal, Finance etc are involved at all necessary stages including in the input, review and approval stages.

ALB

ALBs are required to submit annual Pay Remits for all staff groups, which should be reviewed (includes ensuring calculations and information supporting the Pay Remits are accurate and complete etc.) and approved by relevant experts in the ALB before formal submission to the relevant Accounting Officer (AO). This applies even if the staff group follows a nationally determined pay settlement or chooses to follow the NICS pay award.

As with all aspects of public expenditure, responsibility for value for money, affordability and all regularity issues associated with annual Pay Remits sits with the appropriate AO.

Department

Departments are responsible for approving relevant annual Pay Remits and liaising with Supply on the submission of annual Pay Remits or other cases where DoF approval may be required.

DoF

DoF provides advice to Departments on the pay FD letter and this guidance in relation to information requirements and will challenge departments when it considers the guidance has not been applied properly. Relevant experts in DoF will also consider whether annual Pay Remits raise associated issues in relation to the control of public expenditure, affordability, departmental delegations, the need for wider approvals etc.

Approvals Process

ALBs and departments should ensure that pay commitments are not entered into prior to the appropriate approvals having been secured.

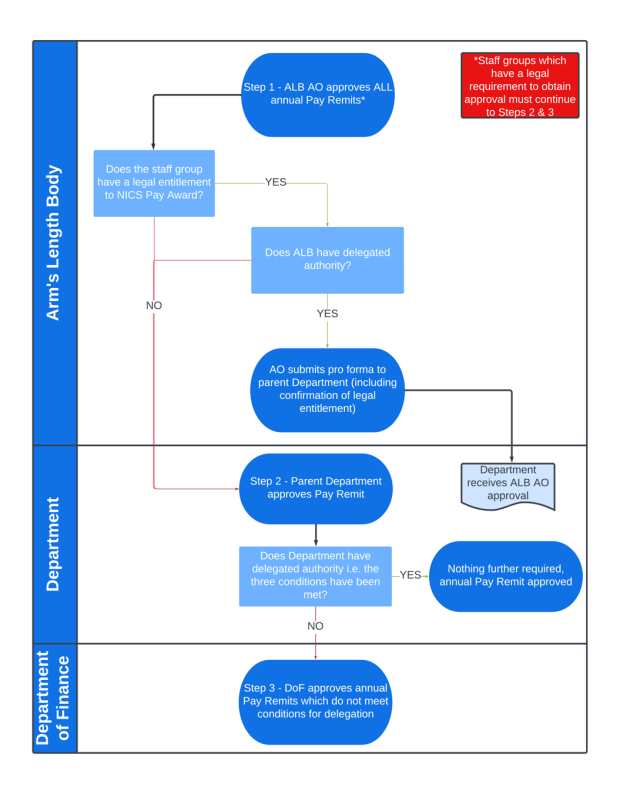

There are three potential steps within the approval process for an annual Pay Remit which are set out below and can be completed via the annual Pay Remit pro forma.

- Step 1: ALB approval for all annual Pay Remits

- Step 2: Departmental approval of Pay Remits for relevant staff groups

- Step 3: Department of Finance approval of Pay Remits for relevant staff groups

Approvals Process Map

Step 1: ALB approval for all annual Pay Remits

Every ALB will need to complete at least Step 1 for all annual Pay Remits.

Almost half of all staff groups have a legal entitlement to receive the NICS pay award and in September 2022, FD (DoF) 07/22 allowed for delegation to be provided to ALBs regarding the Pay Remit/approvals process for these staff groups.

Granting such authority to an ALB would be conditional on its AO approving the annual Pay Remit and providing its parent Department with a completed pro forma, including confirmation of legal entitlement to the NICS pay award and affordability for the affected staff group prior to implementing the award. The section on annual Pay Remit approval in the pro forma allows for this which replaces the original template included in FD (DoF) 07/22.

Those staff groups which do not have a legal entitlement to the NICS pay award must continue to Step 2 and submit their annual Pay Remits to their parent Department for Departmental approval, as appropriate.

Step 2: Departmental approval for relevant staff groups

Departmental Ministers will be responsible for approving pay increases or delegating this role within their departments, without seeking DoF approval, where the three approval conditions are met. It is for individual Ministers to choose if they wish to provide delegated authority to their department’s Accounting Officer in respect of approving pay proposals within their delegation. The conditions for delegated authority to departmental Ministers are:

- The ALB’s staff groups have: an established legal requirement; such as a contractual entitlement e.g., to a nationally agreed pay award; or to pay progression within established pay scales;

- The pay proposal is not novel, contentious, or potentially repercussive (Managing Public Money Northern Ireland (MPMNI) 2.1.7) or precedent setting; or

- There is no discretion regarding the quantum of a contractual entitlement (e.g., inflationary uplift).

Approval should be sought from DoF where any of the above three conditions are not met. Both departmental Minister and DoF Minister approval is required in such cases and any annual Pay Remit submissions to DoF must include Ministerial approval. This can be covered by completing Step 2 in the annual Pay Remit pro forma.

Step 3: Department of Finance approval for relevant staff groups

Pay Remits covering a small number of staff groups require DoF approval, i.e. where any of the above conditions relating to departmental Minister delegated approval are not met. Step 3 must be completed for such staff groups.

Annual Pay Remits with statutory requirement for DoF approval

Any staff group in an ALB with a legal requirement to obtain Departmental / DoF approval must continue to Steps 2/3.

There is also a need to comply with the statutory requirement for DoF approval of remuneration where that is mandated and there may be particular statutory provisions which direct a particular procedure for securing DoF’s approval. Such statutory provisions take precedence over any implied delegations in this guidance for these groups / ALBs and must be complied with.

Breach of Approved Award in Pay Remit

An annual pay award is approved on the expectation that the ALB will not exceed the approval parameters/conditions based on its submitted Pay Remit. However, since the annual Pay Remits are based on estimates/projections, there may be occasions where the quantum exceeds (or falls below) that approved. The pro forma is designed to allow the ALBs to explain why the previous year’s outturn may differ from that in the Pay Remit for which it gained approval for that year. Explanations could be due to significant changes in the number of staff employed by the ALB or changes to the grade structure during the year. In cases where there are any significant deviations from the approved award, and there are no adequate explanations, DoF may require additional detailed evidence to assess whether the current year’s annual Pay Remit is accurate and also request more information regarding the previous year’s Remit to investigate the circumstances. This must be resubmitted through the normal channels before any commitments on the revised proposals are given. If there is uncertainty as to what constitutes a significant difference, advice should be sought from the relevant DoF Supply Officer (or in the case of ALBs, their relevant Departmental contact).

Test Drilling

As well as reviewing and challenging departments on those proposals where DoF approval is required, DoF may from time-to-time conduct test drilling on annual Pay Remits within Departments’ and ALBs delegations. Should test drilling unearth instances where the public sector pay parameters and guidance has not been applied and implemented properly, then DoF will regard any such expenditure as irregular or illegal (i.e. in those instances where there is a statutory requirement for approval and no established legal requirement, but the organisation has pressed ahead, nonetheless). DoF will consider whether annual Pay Remits raise associated issues in relation to the control of public expenditure, affordability, departmental delegations and the need for wider DoF Supply approvals.

Temporary Cover

Overview

In instances where a staff group has an established legal requirement, such as a contractual entitlement to incremental progression and/or revalorisation to be paid on a specific date, and where this date falls prior to the settlement of any relevant pay negotiations that would allow for a complete annual Pay Remit to be submitted, a submission may be made requesting temporary cover before the date of legal requirement falls due, in advance of a full remit being submitted. This approach enables the parent department to meet established legal requirements whilst regularising expenditure.

The approach set out above extends to cover all elements of the pay award. Therefore, in instances where there is a clear and established legal requirement, such as a contractual entitlement to implementation of a cost of living pay award at a certain point in the year then a submission for temporary cover should be made to the parent department.

If there is a clearly established legal requirement for both revalorisation and progression to be paid on the same date and where the completion of a full annual Pay Remit significantly delays payment beyond this date, then one submission should be made for temporary cover for both elements. In the event that legal entitlement to each element falls on separate dates, every effort should be made to co-ordinate any request for temporary cover in order to simplify the process.

Approval Process

Staff groups seeking temporary cover can be do so by completing the temporary cover pro forma and follow the standard approvals process for annual Pay Remits i.e. approval should be sought from DoF where any of the three conditions are not met, for example, if the request is novel, contentious, or potentially repercussive then DoF approval is required.

The temporary cover pro forma can be found on the Annual Pay Remit pro formas page.

A full annual Pay Remit, including progression and revalorisation, should be submitted to the relevant authority as soon as possible, at which point normal approval processes apply. Note that any temporary cover provided could be withdrawn at this point if there are found to be significant differences between the information provided for temporary cover and the full remit documentation.When a pay-related Business Case is appropriate

Pay-related Business Cases are appropriate and required where a case for change is being made other than annual pay awards. This could include but is not limited to;

- changes to staff Terms & Conditions;

- changes to staff Grading structures;

- reforms to improve business performance and the efficiency of the workforce;

- payment to buy staff out of contractual entitlements.

In these circumstances, option appraisal (a key element of a Business Case) is integral to the assessment of value for money.

It is imperative that all departments adhere to the principles of public sector pay when considering the pay structures for newly established ALBs, when negotiating salaries or contracts of employment for new staff in existing ALBs or when initiating job evaluation exercises. ALBs will need to submit a robust, proportionate and fully costed business case, via their parent department, for their proposals that demonstrates clear value for money. Any ALBs considering this approach (including as to whether an annual Pay Remit or proportionate pay-related Business Case is required) should contact their parent department in the first instance, who should then liaise with DoF Supply.

Better Business Cases NI principles apply to pay-related Business Cases and the guidance for this can be found on the Better Business Cases NI page Supplementary guidance on Pay-related Business Cases will be published in due course.

Contacts

Any queries relating to the annual Pay Remit approval process (including delegated authorities) should be addressed in the first instance to your parent department who can then contact the relevant Department of Finance (DoF) Supply Officer if required.

Queries on the technical aspects of the guidance should be addressed to payguidancequeries@finance-ni.gov.uk.