Rating Cost spreadsheet - user guide (Non Domestic Valuation practice notes)

This page contains helpful information regarding the Rating Cost Guide.

Introduction

This Practice Note has been prepared to produce reliable and consistent building costs for valuations based on the Contractor’s Method for Non-Domestic Revaluation 2023 (Reval2023). It is intended to be used to assess the estimated replacement cost (ERC) of the property (hereditament) at Stage 1 of the Contractors Method, at the Antecedent Valuation Date of 1/10/21. It is not intended to be used for any other purpose, including the preparation of asset valuations.

This Practice Note should be read in conjunction with individual Reval2023 Practice Notes which are based on the Contractor’s Method of Valuation.

The LPS NI Rating Cost Guide 2023 has been compiled through significant partnership working between LPS, Valuation Office Agency (VOA) and Construction and Procurement Delivery (CPD). In updating this cost data, the VOA Built Environment & Mineral Surveyors Team (BEAMS) has employed a range of industry building source data including the Building Cost Information Service (BCIS) and Spon’s Architects and Builders Price Books.

The NI LPS Reval2023 Cost Guide spreadsheet includes:

- The General Non-Scheme Cost Guide spreadsheet tab – containing building cost data that should only be considered for use where required NI buildings costs are not contained in the NI ‘Subject to Scheme’ property category tabs; other rateable structures; plant & machinery, etc.

- The NI Reval2023 Subject to Scheme tabs (containing cost data pertaining to LPS Reval2023 Practice Notes and guidance)

The NI LPS Reval2023 Cost Guide also includes on tabs:

- Civics and Monsanto Obsolescence Scales to be applied at Reval2023

- Additions for External Works

- Contract Size Adjustment

- Professional Fees

- NI Decap Rates

To confirm:

- All costs have been adjusted for NI Location

- All costs are on the basis of GEA.

Practice Note (subject to scheme) costs

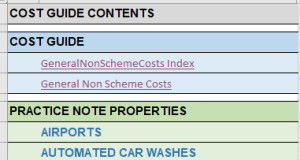

Practice Note costs (Subject to Scheme costs) are shown in the Reval2023 LPS NI Rating Cost Guide spreadsheet as a series of tabs along the bottom of the spreadsheet. A ‘Contents’ index tab is also included with hyperlinks to each tab, so for example:

The cost data contained on the NI bespoke Subject to Scheme tabs is the primary source of data that Practice Note authors should direct valuers to use in the valuation of the specific Practice Note property type. Although costs for similar building types may be found on the General Non Scheme Costs spreadsheet tab, that is because the NI General Non Scheme Costs spreadsheet is derived and adjusted from the VOA Cost Guide – the VOA Cost Guide does not contain individual Subject to Scheme (Practice Note) tabulated costs. Building cost data included on the General Non-Scheme Costs spreadsheet tab should be considered as secondary reference data and should not be substituted for cost data contained in the NI bespoke Subject to Scheme tabs.

General non-scheme costs

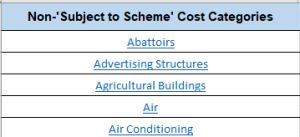

The ‘General Non-Scheme Costs’ tab for Reval2023 includes non ‘Subject to Scheme’ building costs , other rateable structures and industrial/other items classified by generic category e.g. tanks, conveyors, electrics, engines, walls and roads etc. A ‘General Non-Scheme Costs Index’ tab has also been included on the Reval2023 Rating Cost Guide – each entry on the spreadsheet index is hyperlinked to the first entry for that generic category on the ‘General Non-Scheme Costs’ spreadsheet tab, so for example:

Basis of costings

All building costs reflect the following assumptions:

- The whole hereditament is constructed under a single contract assuming competitive tendering in the open market.

- Extensions and adaptations often include extra costs and utilise existing facilities, which are not reflected in the figures given.

- The Estimated Replacement Cost (ERC) is required for the whole of the work based on costs/prices prevailing at the AVD.

- A cleared level site is available without the need for abnormal works.

- All mains services (where required) are available adjacent to the site.

- Professional fees, or other charges, are not included in the rates unless otherwise stated.

- VAT has not been included in any of the costs.

- The cost figures apply to the unit of measurement shown in each case.

GEA and GIA adjustments – further details

Background

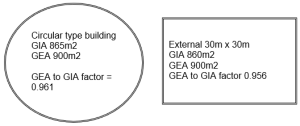

The LPS NI Reval2023 Rating Cost Guide building costs are based on GEA with an assumption that there is an average wall thickness of 300-350mm. It is therefore only necessary to make an alternative adjustment from GIA to GEA where a building, which is subject to a Practice Note, has a wall thickness which deviates substantially from 300-350mm. Where the valuer considers that such exceptional adjustment is required, they should refer it to the Reval2023 HQ team for audit purposes. For reference, a conversion table is included in this User Guide.

Conversion Table GEA to GIA

Where conversion of a survey from GEA to GIA is required the following table may be used in conjunction with the guidance on typical wall thickness.

Building Size - GEA

| Building Size - GEA | |||||||

| Wall | 100m2 | 200m2 | 300m2 | 500m2 | 1000m2 | 2000m2 | 3000m2 |

| 150mm | 0.94 | 0.95 | 0.96 | 0.97 | 0.98 | 0.985 | 0.99 |

| 250mm | 0.92 | 0.93 | 0.94 | 0.95 | 0.965 | 0.975 | 0.98 |

| 350mm | 0.9 | 0.905 | 0.92 | 0.93 | 0.945 | 0.955 | 0.965 |

| 450mm | 0.86 | 0.88 | 0.885 | 0.9 | 0.92 | 0.94 | 0.96 |

| 550 mm | 0.82 | 0.84 | 0.86 | 0.88 | 0.91 | 0.93 | 0.955 |

| 650 mm | 0.78 | 0.81 | 0.84 | 0.87 | 0.9 | 0.925 | 0.925 |

| 750 mm | 0.74 | 0.77 | 0.8 | 0.83 | 0.865 | 0.905 | 0.9 |

| 850 mm | 0.7 | 0.74 | 0.77 | 0.8 | 0.825 | 0.85 | 0.875 |

Effect of Building Shape on GEA and GIA Adjustment Factors

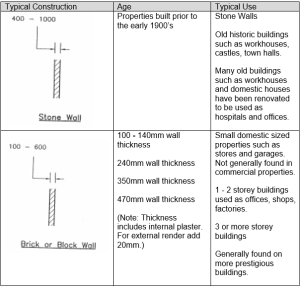

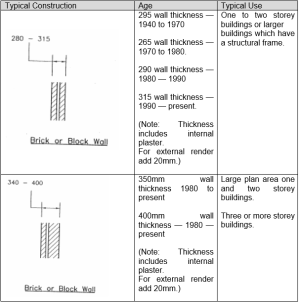

Guidance on wall thickness

Solid Walls

Cavity Walls

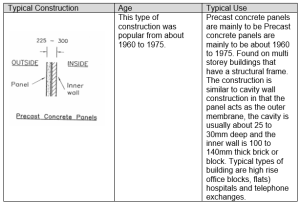

Precast Concrete Panels

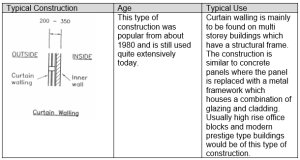

Curtain Walling

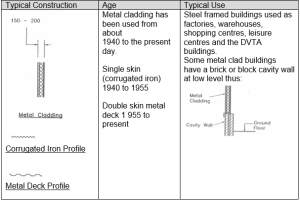

Metal Cladding

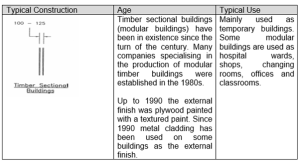

Timber Sectional Buildings