Sewage Works Practice Note Final (Non Domestic Valuation practice notes)

These Practice Notes were developed for the purpose of revaluing non domestic property in Northern Ireland as part of Reval2023. They were produced primarily as guidance for LPS Valuers to ensure, amongst other things, consistency of approach and practice in rating valuations.

Scope

The scope of this Practice Note is solely to ensure a consistent valuation approach for this property Class/Sub Class/Type for Non-Domestic Revaluation 2023 and subsequent entry in the new Valuation List which becomes effective on 1st April 2023.

The basis of valuation for new entries in the Valuation List, or Rating Revision cases after 1st April 2023, is Schedule 12 (2)(1) of the Rates (NI) Order 1977.

Description

This practice note refers to property classified as:

Class: Miscellaneous Public Service Properties

Sub Class: Central GOVT Specialised Properties

Type: Sewage Works

There are currently 762 entries in the Valuation List for this property classification.

Sewage Treatment – A Short Overview of the Basic Process

Water is supplied to all dwelling houses and non-domestic properties, whether from a main NI Water supply or a private supply from a well or spring. This water is used, other than for drinking, to prepare food, wash dishes, clothes, bath/showering, toilet flushing etc and when it leaves the property the water becomes “sewage”. This then makes its way to either a privately owned and maintained septic tank or to a public waste water treatment works in the ownership of NI Water.

Waste Water Treatment Works (WWTWs) ensure that sewage is treated to such a degree that when it is eventually discharged to streams, rivers or coastal waters, these waters do not become polluted and thereby a danger to fish, wildlife and ultimately the general public.

Standards for the quality of effluents from sewage works discharging to rivers and coastal waters is defined and governed by the European Commission Urban Waste Water Treatment Directive 1991 (91/271/EEC), which has been transposed into legislation in Northern Ireland by The Urban Waste Water Treatment Regulations (Northern Ireland) 2007.

Waste water treatment involves:

- The removal of solids by physical screening or sedimentation.

- The removal of soluble and fine suspended organic pollutants by biological oxidation and adsorption processes.

Both forms of treatment produce sludge as by-products and this sludge has to be treated and used or disposed of in an economical and environmentally acceptable method.

Treatment of raw sewage to a product that is safe to discharge to rivers/ coastal waters works by way of a process of gradually converting raw sewage to grey water and then to a relatively inert water and treated sludge. The process in a very basic form is as set out below:

Preliminary Treatment

Screening: Large solids such as plastic bags, rags, nappies, nappy wipes etc. are removed by mechanical screens, generally the bars of which are 6 mm apart. What is removed at this stage is generally compressed and then taken away directly to landfill or incineration.

The next stage is grit removal. The screened effluent is slowed down in a detritor, to allow grit and glass to deposit out but not slow enough for other matter in the suspension to be deposited. Grit and glass at the bottom of the detritor is removed to landfill. The effluent left behind, is now moved on to the primary treatment stage.

Primary Treatment: This stage removes the solids in the effluent suspension by settlement, and takes places in a Primary Settlement Tank. The primary settlement tanks allow more of the solids to settle to the bottom of the tank. What settles to the bottom is known as “primary sludge”, which is then taken off for additional and separate treatment.

Secondary Treatment: The liquid which exits the settlement tank via the weir at the top is known as “settled sewage”. Air is now introduced to encourage the aerobic breakdown of harmful matter by one of two basic methods. In smaller works settled sewage can be spread over percolating filter beds in a slow trickle for aerobic biological treatment to occur. At larger works the sewage is mixed for several hours with an aerated suspension of flocs of microorganisms in an aeration tank, which is known as activated sludge treatment.

Sludge Treatment: All methods of sewage treatment generate organic sludges as a by-product, but due to their high level of oxygen demand they cannot be allowed to be discharged directly to streams, rivers or coastal waters. It is therefore necessary to treat sludges in such a way as to permit eventual safe disposal.

Sludges produced by sewage treatment are organic in nature and contain plant nutrients such as nitrogen, phosphorous and essential trace elements which can be used for agricultural purposes such as a fertiliser. If it cannot be used for agricultural purposes then it has to be disposed of by way of landfill or incineration.

After treatment through a sewage works the sludge will still have a high water content, approximately 96-99%.

Treatment involves the initial removal of excess water and then further treatment by anaerobic digestion. The sludge is stored in an anaerobic digester which is basically an airtight heated tank. The sludge is stored here for 12-20 days at a temperature 35 degrees Centigrade. After this treatment, odour is reduced and the sludge is suitable for final disposal. A by-product of anaerobic digestion is the production of methane gas. This gas can be used to run electrical generators on site and to heat the digester itself.

Legislative Background

Schedule 12 Part 1 Paragraph 1 of the Rates (NI) Order 1977 applies.

“Subject to the provisions of this Order the Net Annual Value of a hereditament shall be the rent for which, one year with another, the hereditament might, in its actual state, be reasonably expected to let from year to year, the probable average annual costs of repairs, insurance and other expenses (if any) necessary to maintain the hereditament in its actual state, and all rates, taxes or public charges (if any), being paid by the tenant”.

Art 37 (2) of the Rates (NI) Order 1977 applies.

Subject to the supplementary provisions set out in Column 3 of Schedule 11 in relation to any entry numbered in Column 1 of that Schedule, the properties specified in Column 2 of that Schedule in relation to that entry shall not be treated as hereditaments for the purposes of this Order.

Schedule 11 of the 1977 Order prescribes properties which are not rateable hereditaments. Entry Number 9 in Schedule 11 states:

9 | Sewers and manholes, ventilating shafts, pumping stations, pumps or other accessories belonging to a sewer. |

The provision of water and sewerage services within NI is governed by the Water & Sewerage Services (NI) Order 2006 and establishes The Northern Ireland Authority for Utility Regulation.

Case law has established that rateability starts only where treatment of effluent starts, and the sewer is deemed to have finished.

In S R Hoggett (VO) .v. The Mayor, Aldermen and Burgesses of The Borough of Cheltenham LT 13/1938 treatment was found to start at the screens, and in Fife County Council .v. Fife Assessor 1965, treatment was considered to be the physical maceration of sewage prior to discharge to the sea.

Valuation approach for 2023

All of the waste water treatment works in NI are owned and occupied by NI Water, for this reason there is no available rental, or receipts and expenditure evidence available to facilitate the valuation of this class of property on the comparative or R+E basis. The basis of valuation shall therefore continue to be the Contractor’s method of valuation. To ensure consistency of assessments a shorthand version of the Contractor’s method is used.

The Contractor’s Basis of Valuation

The overall aim of the Contractor’s basis is to arrive at the effective capital value (ECV) that is then converted into annual rent. The primary method of arriving at ECV is to consider replacement building costs suitably adjusted.

Source: RICS guidance note: The Contractor’s Basis of Valuation for Rating Purposes 2nd edition August 2017, from the Joint Professional Institutions' Rating Valuation Forum which is made up of representatives of the RICS, the IRRV, the RSA, the SAA, LPS and the VOA.

The method is employed in the case of properties that are not normally let out, which by their nature do not lend themselves to valuation by comparison with other classes where rental evidence does exist, and which are not of the type where a valuation solely by reference to the accounts of the undertaking would be appropriate.

The recommended approach to valuation comprises five stages.

Stage 1: Estimated Replacement Cost (ERC)

Identify the extent of the rateable hereditament, then estimate the replacement cost of the buildings, site works, all rateable structures, and rateable plant and machinery within the property on an undeveloped site.

In order to achieve consistency, a unit cost approach using Cost Guides is the primary method adopted. This approach will include the prevailing costs in the identified location, the effect of any contract size, and any associated professional fees. VAT is excluded, as are any grants or donations.

There may be cases where it would be appropriate to cost a modern, simpler or smaller substitute. The substitute would be of a design and specification that enables the use of the actual property to be carried out in a fully satisfactory manner.

Stage 2: Adjusted Replacement Cost (ARC)

The ERC should be adjusted to take account of the difference between the property, in its actual state, and the replacement property costed at Stage 1.

Stage 2 adjustments can be viewed from the perspective of an owner-occupier, as opposed to Stages 1 and 3 which are concerned with capital sums.

Allowances made at this stage are intended to reflect the disadvantages of a particular building (or an item of plant and machinery within it). These allowances are generally termed obsolescence.

It should not be automatically assumed that because a property is old it merits an allowance. In certain circumstances, age may be a positive asset or have little effect, for example prestige buildings such as town halls, art galleries or universities. Age in itself is not a disability but rather what flows from age.

Where a modern substitute has been costed at stage 1, allowances at Stage 2 should be restricted to the disadvantages of occupying the actual buildings in comparison with occupying the costed substitute.

The deficiencies that may be taken into account at Stage 2 can be grouped under the heading of ‘obsolescence’ and they are normally subdivided into the following types:

Physical obsolescence which relates to wear and tear of the building due to its age. Although age itself is not a justification for an allowance the tenant will reflect the prospect of increased maintenance and running costs in his rental bid.

Functional obsolescence may occur when the functional capability of the property is not comparable to new building or design standards in the sector. Functional obsolescence may take the form of the building exceeding the required capacity or quality compared to current market standards, or conversely being less than adequate for the intended purpose.

Technological obsolescence is an extension of functional obsolescence where current technology has changed so radically that the actual plant and machinery to be valued or the building housing such equipment has become redundant.

For Reval2023, adjustments will apply for Age Obsolescence appropriate to the property class.

Stage 3: Value of Land

The consideration of the land element comprises two stages. The first is to establish the capital value of the site of the hereditament. The second is to make such adjustments as may be appropriate to those parts of hereditament site that have been developed with buildings or other rateable structures on it (i.e. encumbered by buildings and to which the average obsolescence allowance that was adopted to the structures at Stage 2 will normally be applied).

The capital value adopted for the land at the first stage, and before adjustment as appropriate at the second stage for the existence of rateable structures, should reflect all the advantages and disadvantages of the site and its location and assume the following:

- The site is cleared of all buildings.

- All services existing at AVD are available for connection.

- There is planning permission for the subject buildings and their existing use.

- No development potential exists over and above that required for the existing buildings or rateable structures on the land.

The assessed capital land value element will be added to form part of the total Effective Capital Value (ECV) to which the appropriate decapitalisation rate should be applied to calculate the Net Annual Value (NAV). [See Stage 4 for details on decapitalisation].

It may be appropriate to consider alternative sites in an area of high land value where the occupier of the property derives no extra benefit therefrom, however, comparisons should be made with sites of a comparable size, in the same mode or category of use.

For certain property types there may be a reasonable amount of reliable market evidence for site rents which can be used. For these property types the value of the land element may therefore be assessed by applying a rental rate per unit of assessment (acres/hectares) derived from analysis of such reliable rental information. Where this method is employed, the decapitalisation rate is not applied to the assessed land rental element, the land rental element instead being added to the decapitalised ECV to form part of the Total NAV for the hereditament.

Stage 4: Apply the appropriate decapitalisation rate to the total ECV.

Decapitalising the sum of Stages 2 and 3 by the appropriate rate converts the ECV to an annual equivalent. The decapitalisation rates are prescribed by legislation, this does not allow any degree of valuation judgement.

Lower rate: 2.27% - in the case of a healthcare, educational or church hereditament.

Standard rate: 3.4% - for all other types.

Stage 5: Review. Also known as the ‘stand back and look’ stage.

This stage is used to consider if any further adjustments are appropriate. Any such adjustments must be made for specific reasons and cannot be used to circumvent the decap rate. Care should be taken to ensure they do not duplicate allowances already made at Stage 2.

Adjustments made at this final stage are to reflect factors that affect the value of the property as a whole, e.g. poor access, cramped site conditions, inadequate layout. This stage provides an opportunity to consider whether a pioneering allowance or allowance to reflect the economic state of the industry is appropriate.

The value arrived at in Stage 5 is rounded to produce the NAV.

For full details see the following documents:

RICS guidance note: The Contractor’s Basis of Valuation for Rating Purposes 2nd edition August 2017.

LPS Code of Measuring Practice

LPS NI Reval 2020 Rating Cost Guide Practice Note

LPS NI Reval2023 Rating Cost Guide Spreadsheet

LPS Contractor’s Basis of Valuation

Shorthand Contractor’s Method of Valuation

To ensure consistency of assessments and having derived a number of rental values from analysis of full Contractor’s valuations, a shorthand version of the Contractor’s method has been developed, whereby an NAV per Population Equivalent Design Capacity of the WWTW is applied.

Waste Water Treatment Works serving up to a Population Equivalent (PE) of 8,000 people, will be carried out by reference to the Table of NAV rates per PE shown at Appendix 1. The pricing adopted includes the land value element.

There are 4 main types of works found within Northern Ireland Water’s network of treatment works:

- Biological Filter plants, both with and without sludge thickening or sludge treatment.

- Rotating Biological Contactor (RBC) and on a small number of occasions Membrane Biological Reactor (MBR) plants.

- Septic tanks and very small rural sites

- Sea outfalls where only screening of waste occurs.

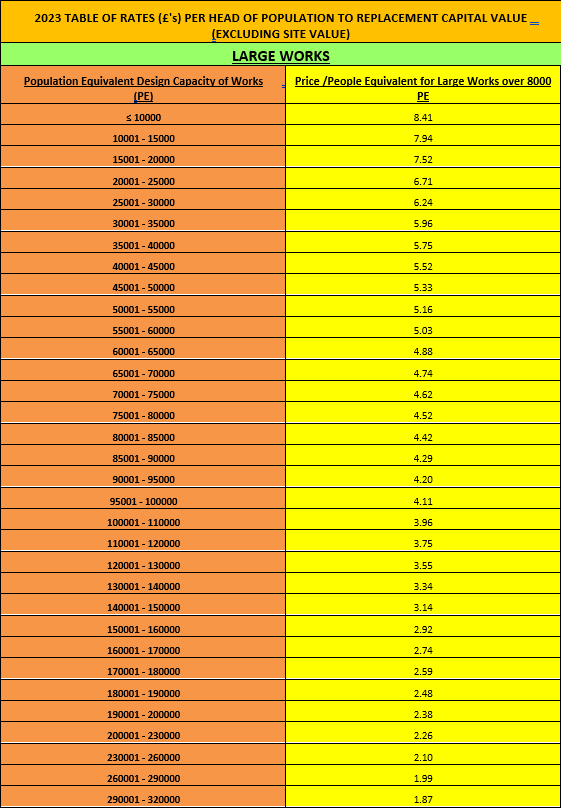

For larger works serving over 8,000 PE, the method of valuation is a full Contractor’s method of valuation. Where a full Contractor’s valuation has not been carried out reference should be made to the Table of NAV Rates per PE as provided in Appendix 2. The table of rates to be used for “Large Works” is exclusive of the land element.

Design Capacity

Treatment works are generally built with a design capacity of at least three times the anticipated average Dry Weather Flow. (Dry weather flow is the daily flow into the works after a period of seven days dry weather). No allowance needs to be made for this additional capacity as it is required to deal with seasonal fluctuations in flow.

If a treatment works serves an area where there is a local tourist industry which may produce different Dry Weather Flows at different times of the year, the works will have been designed to be capable of dealing with the quantity of flow at peak holiday times. In comparison, the flow at off-peak times will be considerably reduced. No over-capacity allowance should be given for tourist season fluctuations.

If, however, a treatment works has been built with a capacity which reflects a projected population increase which has not been reached, and is not likely to be reached between revaluations, or for the treatment of a trade effluent process which may now have ceased, then it may be necessary to make an allowance. The figure for "used capacity" is derived by taking the actual equivalent population as a percentage of the optimum design population.

Actual Population Equivalent of WWTW (supplied by NI Water) X 100

Design Population Equivalent of WWTW (supplied by NI Water)

The following allowances should be applied to works, only where considered appropriate:

Used Capacity | Percentage deduction |

80% or more | NIL |

79.9%-75% | 5% |

74.9%-70% | 10% |

69.9%-65% | 15% |

64.9%-60% | 20% |

59.9%-55% | 25% |

54.9%-50% | 30% |

49.9%-45% | 35% |

44.9%-40% | 40% |

39.9%-35% | 45% |

34.9%-30% | 50% |

29.9%-25% | 52.50% |

24.9% or less | 55% |

Rent and lease questionnaire

For this class of property Rent and lease Questionnaires (RALQs) were not issued.

Contacts

For advice on any aspect of this Practice Note contact LPS on 0300 200 7801.

Appendix 1

Table of NAV Rates per PE for Waste Water Treatment Works serving up to 8,000 Population Equivalents.

Appendix 2

Table of NAV Rates per PE for Waste Water Treatment Works serving over 8,000 Population Equivalents.